Stamp Duty For Tenancy Agreement

Term of a tenancy agreement a to calculate the term of a tenancy agreement both the commencement date and the cessation date will be counted.

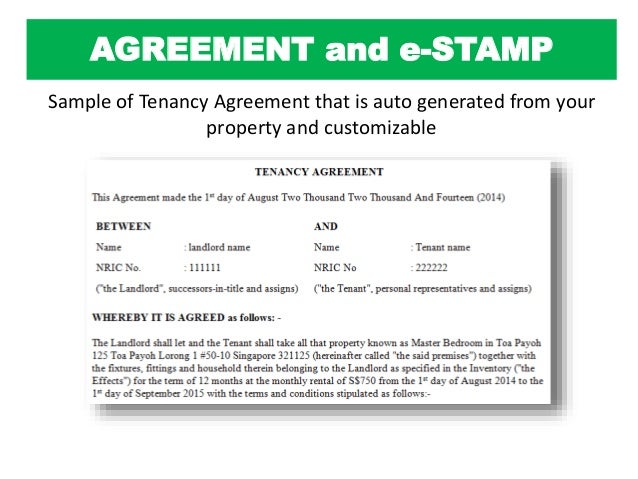

Stamp duty for tenancy agreement. Any written agreement pertaining to any property leasing transaction a lease tenancy document that you are paying stamp duty on. Examples of the computation of stamp duty on tenancy agreements. Online calculator to calculate tenancy agreement stamp duty. The amount of the current stamp duty payable is computed according to the information that you have entered.

B particulars of the parties involved including the following for the tenant. All you need is a registered account with us. Enter the monthly rental duration number of additional copies to be stamped. Stamp duty payable 0 4 of the rent for the extended period from 1 jan 2021 31 mar 2021.

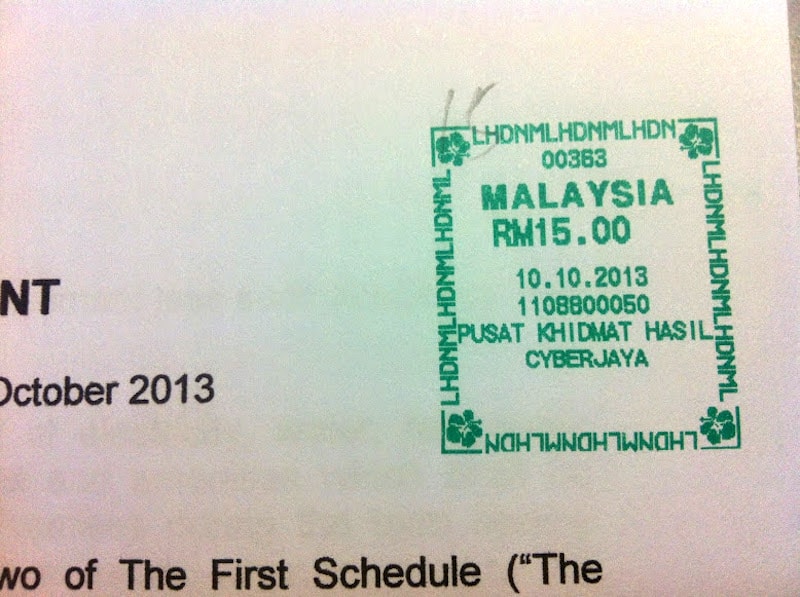

Pay seller s stamp duty or claim for seller s stamp duty remission for housing developers for agreements relating to disposal of properties. I am due for my rental renewal and the landlord sent me an electronic tenancy agreement for review with a note to pay for rm150 stamp duty. Based on the table above stamp duty should be rm72 plus rm10 for an additional copy of duplicate agreement. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949.

Lease with fixed rent. To use this calculator. Example 1 a tenancy agreement commences on 1 january 2010 and terminates on 31 december 2010. The rental is rm1700 per month for a year renewal.

Lease or tenancy agreement. Registered account if you perform e stamping frequently you may wish to sign up as a corppass user and enjoy additional features. For instance the monthly rental for a one year tenancy is rm2 000 so the annual rent is rm24 000. Stamp duty computation landed properties tenancy agreement.

And if the tenancy agreement has been signed for more than 3 years the stamp duty rate will be rm3 for every rm250 of the annual rent in excess of rm2 400. Sale purchase of property seller s stamp duty note. Please input the tenancy details and then press compute.